Understanding the nuances behind shifting market behaviors requires a keen eye on evolving data trends. One such vital approach is Cwin Trend Analysis: Rising Interest Explained, which illuminates the various factors driving increased engagement within specific sectors or investment domains. Whether you’re an investor, analyst, or business strategist, leveraging insights from this analysis helps in making informed decisions about future opportunities.In this article, we will explore how to use Cwin Trend Analysis: Rising Interest Explained, provide real-world examples, compare its significance across sectors, and offer key advice on interpreting rising interest trends effectively.

The Fundamentals of Cwin Trend Analysis – Unveiling Market Movements

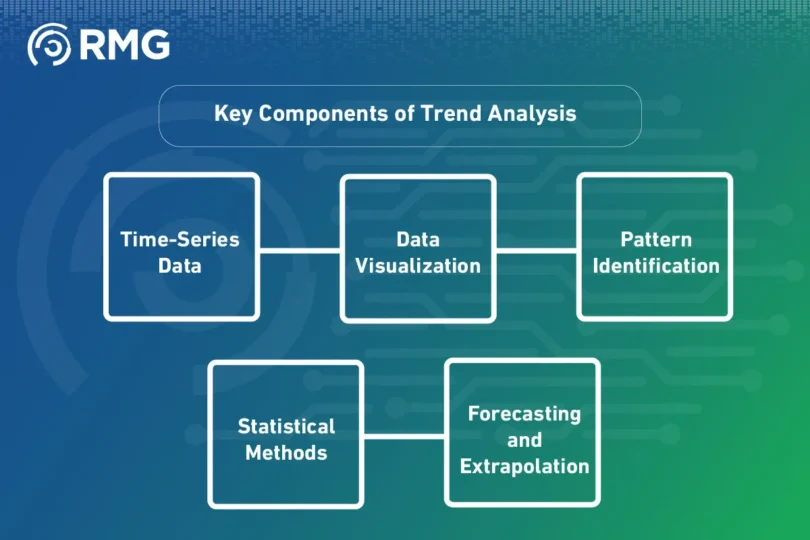

Understanding Cwin Trend Analysis: Rising Interest Explained starts with grasping the core principles behind trend analysis itself. This approach involves monitoring significant variations in engagement, transactions, or attention within a particular market or asset class over time.In essence, Cwin Trend Analysis allows stakeholders to identify where and why rising interest is occurring, facilitating predictive insights and strategic planning. The importance lies in distinguishing between short-term spikes and sustainable growth patterns, which can dramatically influence investment decisions and market positioning.By systematically analyzing these rising interest signals, professionals can anticipate potential shifts before they fully materialize, thus gaining a competitive advantage. Practical application involves collecting reliable data, ensuring accurate interpretation, and integrating insights into decision-making processes to capitalize on emerging opportunities.

The Role of Data in Trend Analysis

Data serves as the backbone of Cwin Trend Analysis: Rising Interest Explained. The accuracy of insights depends heavily on the quality and depth of collected data. Analysts focus on metrics like transaction volume, social media chatter, search interest, and user engagement levels to pinpoint areas experiencing a surge.One of the key challenges here is filtering data noise from genuine growth signals. Sophisticated algorithms and machine learning tools often support this process, enabling more refined insights. When properly leveraged, these tools can reveal underlying causes, such as new product launches, regulatory changes, or shifting consumer preferences.Moreover, as trends evolve, continuous data monitoring ensures that the analysis remains current, providing real-time intelligence to adapt strategies swiftly. The role of contextual understanding, however, remains vital—it’s not just about numbers but about interpreting what these numbers reveal about broader market sentiment.

Practical Examples of Rising Interest Detection

Consider a start-up in the renewable energy sector experiencing a sudden spike in search activity and investor inquiries. Using Cwin Trend Analysis, analysts can verify if the uptick signifies fiscal interest, increased consumer awareness, or media coverage. If confirmed, this insight can guide stakeholders toward strategic investments or partnerships.Another example involves trending cryptocurrencies. As interest in a particular digital asset escalates, trend analysis helps determine whether the surge is driven by speculative behavior, technological developments, or regulatory endorsements. This enables investors to judge if the rising interest is sustainable or a temporary phenomenon, informing risk management strategies.In the retail industry, a sudden spike in demand for eco-friendly products can be analyzed through this lens to evaluate if consumer interest is shifting toward sustainability. Businesses can then align their marketing and procurement strategies accordingly, leveraging the rising interest for growth.

Comparing Cwin Trend Analysis with Other Market Analytical Tools

While Cwin Trend Analysis: Rising Interest Explained offers unique insights, it’s often used alongside other analytical tools to build a comprehensive market picture. Comparing this approach with traditional methods demonstrates its distinct advantages, as well as some limitations.Analysts frequently incorporate fundamental analysis, technical analysis, and sentiment analysis alongside trend insights. Each method has its strengths, but the targeted focus of Cwin Trend Analysis on rising interest signals provides early warnings that other methods might miss or detect later.

Specifically, this method shines when pinpointing nascent trends before they’re fully recognized in the market. It acts as an early indicator, allowing stakeholders to position themselves advantageously. However, purely relying on rising interest signals without context can lead to overestimation, so complementing it with broader analyses is vital.Furthermore, compared to broad macroeconomic assessments, Cwin Trend Analysis isolates specific industry or asset behaviors, helping to tailor strategies more precisely. This distinct focus grants it the ability to serve niche markets or emerging sectors with significant growth potential.

The Limitations and How to Overcome Them

Despite its strengths, Cwin Trend Analysis: Rising Interest Explained faces limitations, such as the risk of false positives—where interest appears to rise but lacks genuine market backing. Over-interpreting short-term trends can lead to misguided decisions, especially in volatile environments.To mitigate these drawbacks, analysts should incorporate historical data comparison and cross-verify findings through multiple sources. Applying filters for data reliability and contextual relevance enhances accuracy. Combining trend analysis with qualitative insights, such as expert opinions and industry reports, strengthens legitimacy.Additionally, the rapid pace of digital information flow means trends can evaporate just as quickly as they appear. Staying agile in analysis and maintaining frequent data reviews is essential. Cultivating a balanced approach ensures Cwin Trend Analysis remains a powerful tool rather than a source of misguided optimism.

Strategizing with Rising Interest Insights – How to Use Cwin Trend Analysis Effectively

In the realm of market analysis, knowledge alone isn’t sufficient—strategic application makes the difference. Utilizing Cwin Trend Analysis: Rising Interest Explained involves understanding when and how to act on emerging signals, turning insights into opportunities.Advising stakeholders on this front requires a nuanced approach that emphasizes timing, validation, and integration with broader strategic frameworks. Here, we explore practical advice to maximize the benefits of rising interest trends uncovered through analysis.

Timing Is Everything

Recognizing a rising interest trend is just the first step; acting at the right time injects real value into strategic initiatives. Early detection through Cwin Trend Analysis offers a window of opportunity before the trend becomes mainstream.The challenge lies in discerning whether the interest surge is transient or indicates a sustainable shift. Experts advise setting predefined thresholds for engagement metrics, enabling response actions at optimal moments. Awareness of external factors, such as seasonal effects or regulatory changes, also plays a crucial role in timing decisions.Furthermore, adjusting tactics based on trend momentum—like increasing marketing efforts or diversifying product lines—can capitalize on the burgeoning interest. Conversely, knowing when to pull back prevents overextension and preserves value.

Validation and Cross-Verification

While Cwin Trend Analysis can uncover promising signals, validation remains key. Combining these insights with other data and qualitative inputs ensures a more balanced view. For instance, corroborating rising interest patterns with customer surveys, industry reports, and competitor analyses reinforces confidence.In practice, investors and managers should develop a multi-dimensional verification process. Timely validation reduces risks of false positives and ensures resources are allocated prudently. Integrating feedback mechanisms, such as tracking initial outcomes and adjusting strategies accordingly, enhances overall effectiveness.

In today’s fast-paced market landscape, a disciplined validation process also fosters agility. It enables stakeholders to pivot quickly when signals indicate shifting dynamics, maintaining competitive advantage amid uncertainty.

Embedding Trend Insights into Strategic Planning

To truly leverage Cwin Trend Analysis: Rising Interest Explained, trend insights must be embedded into the strategic decision-making framework. Regular monitoring, combined with scenario planning, allows organizations to adapt proactively.Establishing routine review cycles—such as quarterly or monthly trend assessments—ensures ongoing relevance. These sessions should involve cross-departmental teams to interpret data from various perspectives, enriching the understanding of rising interest implications.

Moreover, integrating emerging trend data into risk management and opportunity identification processes allows for more resilient planning. Establishing clear protocols on how to respond to upward interest signals helps organizations seize advantages swiftly, fostering innovation and growth.In essence, the strategic deployment of trend insights is about creating a dynamic ecosystem where data-driven decisions propel growth, minimize risks, and optimize resource allocation.

Conclusion

In summary, tải app cwin Trend Analysis: Rising Interest Explained is an invaluable tool that unlocks early insights into evolving market dynamics. By understanding its core principles, comparing it with other analytical methods, and applying strategic timing and validation, stakeholders can harness emerging trends effectively. As markets become increasingly digital and data-driven, mastering this analysis type will be essential for making foresighted, informed decisions that capitalize on rising interest phenomena.